LAWTON, Okla. – Each credit card issuer has its own unique policies to combat fraud and what it sees as churning practices.

Chase has its infamous 5/24 rule that prevents you from opening a new Chase card if you’ve opened five or more cards in the last 24 months. Amex has historically been laxer with card approvals but has been cracking down on welcome bonus eligibility by enforcing one of the lesser-known rules in its terms and conditions.

Here’s a word to the wise: Amex can take back your welcome bonus — or even close your account — if you cancel or downgrade your account within 12 months of opening.

New to The Points Guy? Sign up for our daily newsletter and check out our beginner’s guide.

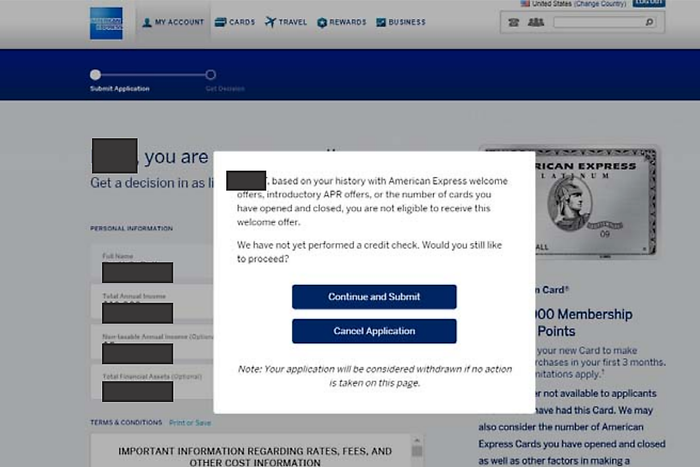

The Amex eligibility pop up

A couple of years ago, Amex added a pop-up screen that appears before you submit your application and warns you if you aren’t eligible for a welcome bonus. There was no hard and fast rule as to what caused this ineligibility, other than Amex’s long-standing policy that you can’t earn a welcome bonus on a card if you’ve already had it before.

Additionally, it seems that most Amex cardholders will be restricted to at most four Amex consumer or business credit cards.

Still, many people found themselves being denied welcome bonuses on products they’d never had or hadn’t hit these card limits.

The good news was that Amex gave this warning before you submitted your application, giving you a chance to exit out without having your credit report pulled, which can lead to a small dip in your credit score in the short term.